If you’re facing a hysterectomy and wondering about the financial aspects of the surgery, you’re not alone. Many women considering this procedure have similar questions, particularly regarding insurance coverage.

So, how much does a hysterectomy cost with Blue Cross Blue Shield? In this post, I’ll break down the costs, what’s typically covered by insurance, and how to plan for any additional expenses. Let’s dive in!

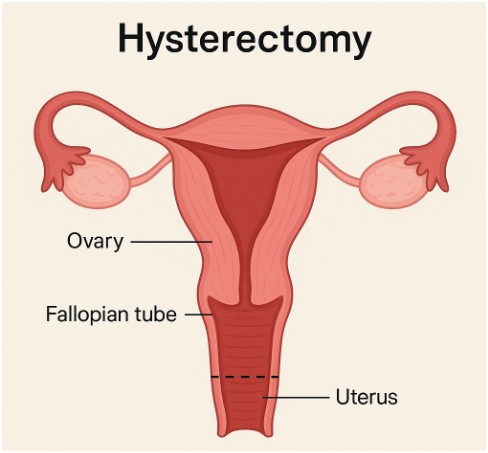

What is a Hysterectomy?

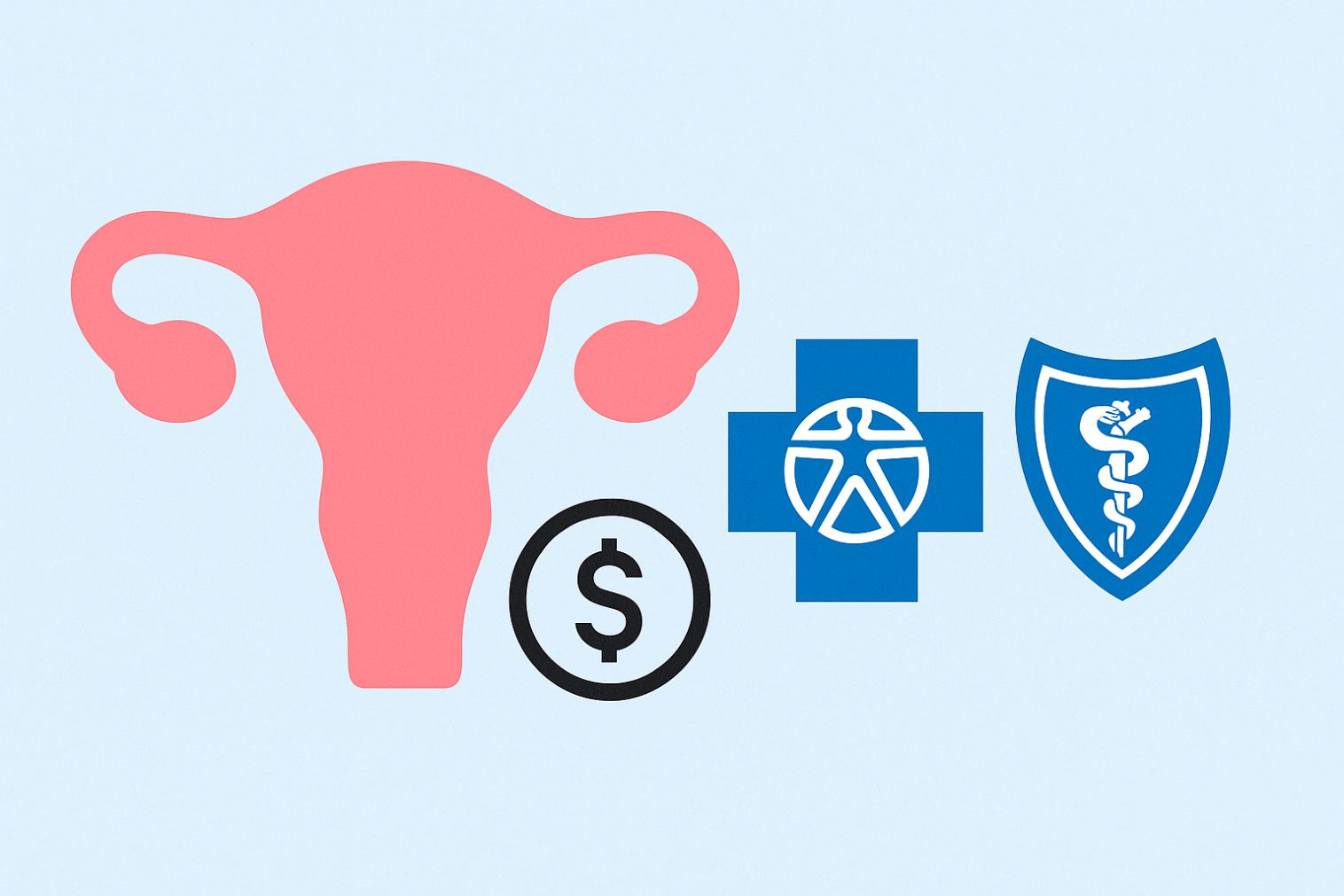

A hysterectomy is a surgical procedure in which a woman’s uterus is removed. This may be done for various medical reasons, including conditions such as fibroids, cancer, or endometriosis. There are different types of hysterectomy procedures, and the costs can vary depending on the method used.

Types of Hysterectomy and Their Costs

Image credit- Wikipedia

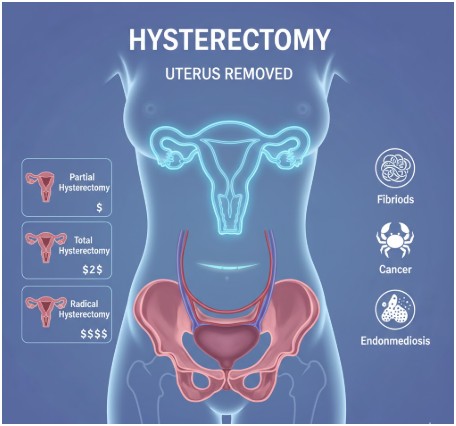

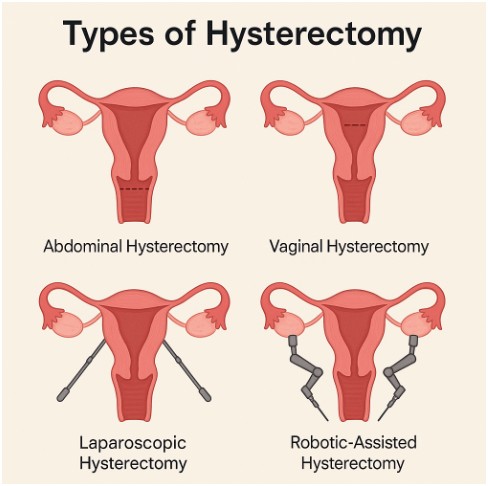

The type of hysterectomy you undergo can significantly impact the overall cost. Here are the main types of procedures:

- Abdominal Hysterectomy – This is the most invasive type, where the uterus is removed through an incision in the abdomen. The cost for an abdominal hysterectomy typically ranges from $10,000 to $20,000, depending on where you live and the hospital where the surgery is performed.

- Vaginal Hysterectomy – This less invasive method involves the removal of the uterus through the vaginal canal. The cost of this procedure is usually slightly lower than an abdominal hysterectomy, ranging from $8,000 to $15,000.

- Laparoscopic or Robotic-Assisted Hysterectomy – These minimally invasive surgeries use small incisions and robotic technology for greater precision and faster recovery. This option usually costs between $12,000 and $18,000.

The prices mentioned above are estimates and can vary significantly depending on your location, the surgeon’s fees, and the facility you choose.

How Much Does a Hysterectomy Cost with Blue Cross Blue Shield?

When it comes to insurance coverage for a hysterectomy, Blue Cross Blue Shield (BCBS) typically provides coverage for medically necessary procedures, including hysterectomies. However, there are some important factors to consider:

- Plan Type – Depending on your specific Blue Cross Blue Shield plan, your out-of-pocket costs will differ. Plans vary in terms of co-pays, deductibles, and coverage levels. For example, a Bronze Plan may have lower premiums but higher out-of-pocket costs, while a Gold Plan may have higher premiums but lower deductibles.

- Pre-authorization – BCBS often requires pre-authorization for elective procedures, such as hysterectomies. This means your doctor may need to submit documentation showing that the procedure is medically necessary before BCBS will cover it.

- In-Network vs. Out-of-Network Providers – If you choose a surgeon or facility that is in-network with Blue Cross Blue Shield, your costs will likely be lower. Going out-of-network can significantly increase your costs, as you’ll be responsible for a larger portion of the expenses.

Insurance Coverage for a Hysterectomy

When Blue Cross Blue Shield covers a hysterectomy, the major costs (such as the surgeon’s fee, anesthesia, and hospital charges) are typically covered. However, there are still other expenses that you may need to account for:

- Co-pays – This is the amount you pay at the time of service, and it can vary based on your plan.

- Deductibles – Your deductible is the amount you must pay out of pocket before your insurance coverage begins. Some plans may have a high deductible, which can increase the overall cost of the surgery for you.

- Out-of-Pocket Maximum – BCBS plans also have an out-of-pocket maximum, which limits how much you’ll have to pay in a year. Once you reach this amount, BCBS will cover 100% of the costs.

It’s essential to contact BCBS directly to obtain a precise breakdown of what your plan will cover. If you’re unsure, you can always ask for help from your healthcare provider’s billing department to clarify the financial details.

Additional Costs to Consider Beyond the Surgery

While the hysterectomy cost with Blue Cross Blue Shield will cover most of the surgery itself, there are additional costs that are important to plan for. Here are a few common additional expenses:

- Pre-Surgery Consultation – Before the surgery, you’ll need to have consultations, which may include lab tests, imaging, and other assessments. These are often covered by insurance but may require separate co-payments.

- Medications – You may need medications for pain management or antibiotics to prevent infection after a hysterectomy. These costs can add up, so it’s important to check with your insurer to see which medications are covered.

- Post-Surgery Recovery – If you need to stay in the hospital overnight or for several days, this can increase the overall cost of the procedure. However, if you have a short hospital stay, your insurance should cover most of the expenses, aside from the co-pays.

- Physical Therapy – If your recovery involves physical therapy, this may also incur additional costs. Depending on your insurance plan, physical therapy may be partially covered.

Financial Assistance for Hysterectomy Surgery

Even with insurance, the cost of hysterectomy surgery can still be a financial burden. Here are some options to help you manage these expenses:

- Payment Plans – Many hospitals and surgical centers offer payment plans, allowing you to spread the cost over several months.

- Charity Programs – Some hospitals have charity care programs that help low-income patients with medical costs.

- Health Savings Accounts (HSAs) or Flexible Spending Accounts (FSAs) – If you have an HSA or FSA, you can use these funds to pay for out-of-pocket costs.

Conclusion

If you’re wondering how much does a hysterectomy cost with Blue Cross Blue Shield, the answer depends on several factors including your specific insurance plan, the type of hysterectomy, and whether you go to an in-network or out-of-network provider.

While BCBS generally covers most costs, it’s essential to understand the details of your plan, including deductibles, copays, and out-of-pocket maximums.

Please contact both your doctor and Blue Cross Blue Shield to clarify any questions you may have regarding costs and coverage. Planning ahead and understanding your options can help you manage the financial side of this important surgery.